With the rapid development of digital transactions, the use of digital wallets has become a popular and convenient way to manage money. A digital wallet, also known as an e-wallet, electronic wallet, or mobile wallet, is a software or application that stores a user's payment information and enables transactions through a digital device, such as a smartphone or computer.

Digital wallets work by linking a user's payment information to their smartphone or computer. When a user makes a payment, the digital wallet sends encrypted payment information to the merchant or recipient, without revealing the user's personal information. The transaction is completed within seconds, providing a quick and easy payment experience.

Digital wallets work by linking a user's payment information to their smartphone or computer. When a user makes a payment, the digital wallet sends encrypted payment information to the merchant or recipient, without revealing the user's personal information. The transaction is completed within seconds, providing a quick and easy payment experience.

There are many digital wallets available in the market, each with its unique features. Some popular digital wallets include:

- PayPal

- Apple Pay

- Google Pay

- Samsung Pay

- Venmo

- Alipay

- WeChat Pay

There are many digital wallets available in the market, each with its unique features. Some popular digital wallets include:

- PayPal

- Apple Pay

- Google Pay

- Samsung Pay

- Venmo

- Alipay

- WeChat Pay

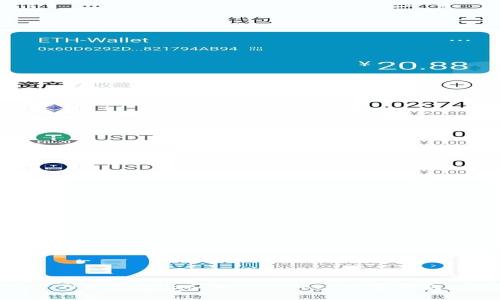

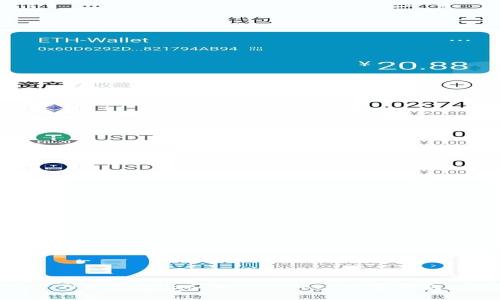

What is a digital wallet?

A digital wallet is a secure and convenient way to manage payments and personal information. It allows users to store multiple credit or debit cards, bank account details, and other payment methods in one place. Users can then use these stored payment methods to make purchases online or in stores, transfer money to others, or pay bills.How does a digital wallet work?

Digital wallets work by linking a user's payment information to their smartphone or computer. When a user makes a payment, the digital wallet sends encrypted payment information to the merchant or recipient, without revealing the user's personal information. The transaction is completed within seconds, providing a quick and easy payment experience.

Digital wallets work by linking a user's payment information to their smartphone or computer. When a user makes a payment, the digital wallet sends encrypted payment information to the merchant or recipient, without revealing the user's personal information. The transaction is completed within seconds, providing a quick and easy payment experience.

What are the benefits of using a digital wallet?

Using a digital wallet has several benefits, including: - Convenience: Users can make payments from their smartphone or computer, without the need to carry cash or credit cards. - Security: Digital wallets use encryption technology to protect user information, making it more difficult for hackers to steal payment information. - Cost-effective: Some digital wallets offer rewards programs and discounts, providing users with lower transaction fees or cashback rewards. - Accessibility: Digital wallets are available to anyone with a smartphone or computer and an internet connection, making it an accessible payment method for people around the world.What are some popular digital wallets?

There are many digital wallets available in the market, each with its unique features. Some popular digital wallets include:

- PayPal

- Apple Pay

- Google Pay

- Samsung Pay

- Venmo

- Alipay

- WeChat Pay

There are many digital wallets available in the market, each with its unique features. Some popular digital wallets include:

- PayPal

- Apple Pay

- Google Pay

- Samsung Pay

- Venmo

- Alipay

- WeChat Pay